All Categories

Featured

Table of Contents

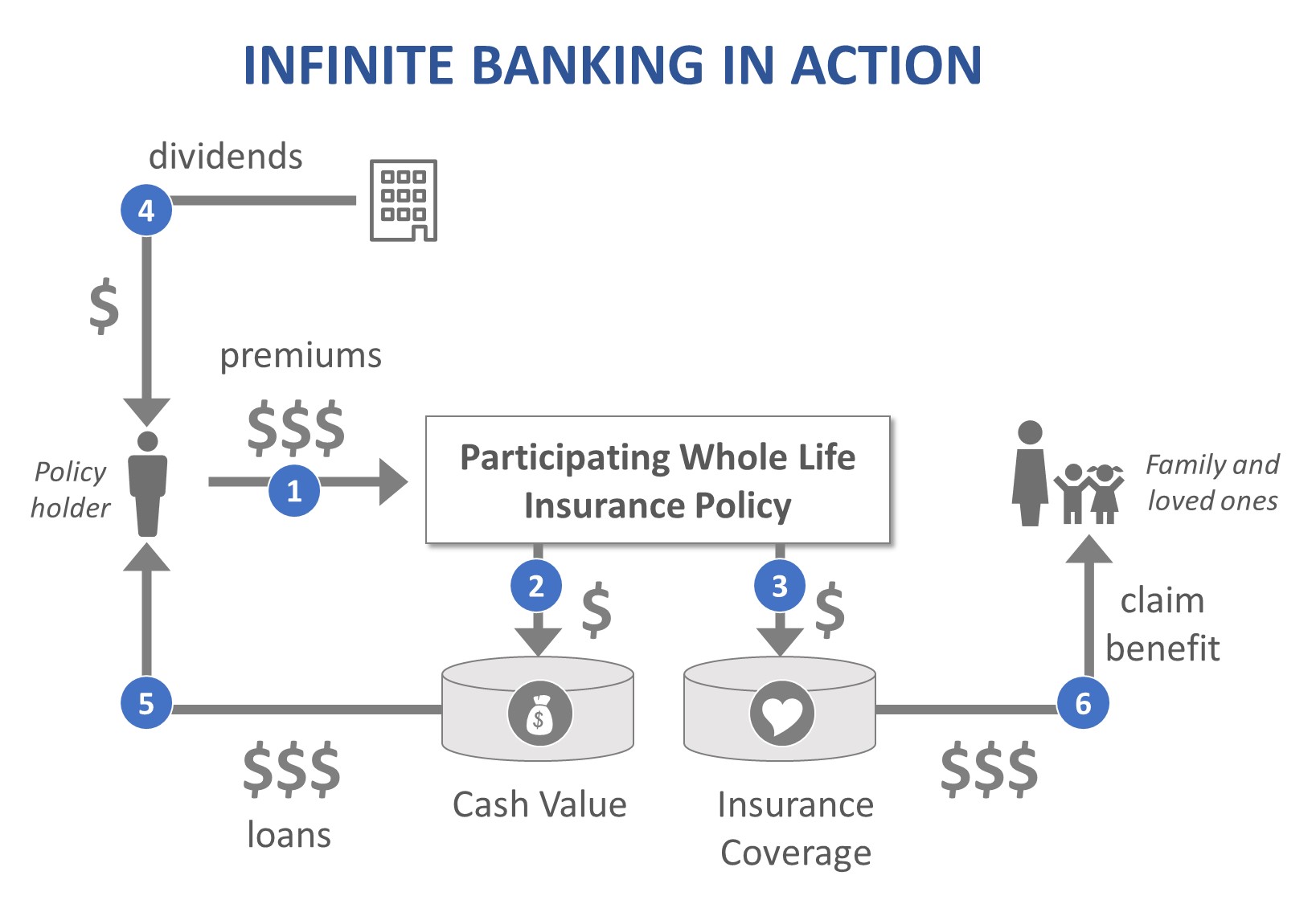

The strategy has its own advantages, but it likewise has problems with high charges, complexity, and more, causing it being concerned as a scam by some. Limitless financial is not the ideal policy if you need just the investment element. The boundless financial principle focuses on the usage of whole life insurance coverage plans as a financial device.

A PUAR enables you to "overfund" your insurance plan right up to line of it coming to be a Modified Endowment Agreement (MEC). When you use a PUAR, you quickly raise your cash money worth (and your survivor benefit), thereby increasing the power of your "financial institution". Additionally, the more cash money value you have, the higher your interest and dividend settlements from your insurance coverage business will certainly be.

With the surge of TikTok as an information-sharing system, monetary recommendations and methods have discovered a novel means of spreading. One such technique that has been making the rounds is the infinite financial concept, or IBC for brief, amassing recommendations from stars like rapper Waka Flocka Fire - Infinite Banking concept. While the method is currently popular, its roots map back to the 1980s when financial expert Nelson Nash presented it to the world.

How secure is my money with Policy Loan Strategy?

Within these policies, the cash money worth grows based on a rate set by the insurer. As soon as a considerable cash money worth accumulates, policyholders can acquire a cash worth financing. These fundings differ from conventional ones, with life insurance coverage acting as collateral, suggesting one might lose their coverage if borrowing excessively without ample money value to support the insurance prices.

And while the allure of these policies appears, there are innate constraints and risks, demanding diligent cash money worth tracking. The method's authenticity isn't black and white. For high-net-worth individuals or company proprietors, particularly those utilizing approaches like company-owned life insurance (COLI), the benefits of tax breaks and substance development might be appealing.

The appeal of boundless financial doesn't negate its obstacles: Price: The fundamental requirement, an irreversible life insurance coverage policy, is costlier than its term equivalents. Eligibility: Not everyone gets approved for entire life insurance policy because of strenuous underwriting procedures that can omit those with certain health or way of life conditions. Intricacy and threat: The complex nature of IBC, combined with its dangers, may prevent many, specifically when less complex and less dangerous options are offered.

Can I access my money easily with Self-financing With Life Insurance?

Alloting around 10% of your monthly earnings to the policy is just not practical for many people. Component of what you read below is simply a reiteration of what has actually already been stated above.

Prior to you get on your own right into a situation you're not prepared for, recognize the following first: Although the principle is generally marketed as such, you're not actually taking a car loan from on your own. If that held true, you would not have to repay it. Rather, you're obtaining from the insurance provider and need to repay it with interest.

Some social media articles recommend using cash money worth from entire life insurance to pay down debt card debt. When you pay back the funding, a part of that passion goes to the insurance policy business.

How flexible is Cash Value Leveraging compared to traditional banking?

For the initial several years, you'll be paying off the payment. This makes it incredibly tough for your policy to collect worth during this time. Unless you can pay for to pay a couple of to a number of hundred bucks for the following decade or more, IBC won't work for you.

Not everyone should depend entirely on themselves for financial protection. Borrowing against cash value. If you require life insurance policy, below are some beneficial pointers to take into consideration: Consider term life insurance policy. These policies provide coverage throughout years with significant economic obligations, like home mortgages, student loans, or when looking after young children. Ensure to go shopping about for the very best price.

Can I use Borrowing Against Cash Value for my business finances?

Picture never having to stress regarding financial institution loans or high passion prices again. That's the power of infinite banking life insurance coverage.

There's no set funding term, and you have the flexibility to choose the payment schedule, which can be as leisurely as repaying the funding at the time of fatality. This versatility encompasses the maintenance of the financings, where you can choose interest-only repayments, maintaining the financing balance flat and convenient.

How do I optimize my cash flow with Infinite Banking Vs Traditional Banking?

Holding money in an IUL repaired account being credited passion can typically be much better than holding the cash money on down payment at a bank.: You have actually always imagined opening your very own bakeshop. You can borrow from your IUL policy to cover the initial expenses of renting a space, acquiring devices, and working with staff.

Individual financings can be acquired from typical banks and cooperative credit union. Below are some bottom lines to consider. Bank card can supply a flexible way to obtain money for very short-term periods. Borrowing money on a debt card is typically really costly with annual percentage rates of interest (APR) frequently getting to 20% to 30% or more a year.

Latest Posts

Whole Life Insurance Bank On Yourself

How To Become Your Own Bank With Life Insurance

Infinite Banking Concept Calculator